Bengaluru, November 22, 2024: In recent years, momentum as an investment strategy has gained significant traction in India, as investors increasingly seek to capitalize on market trends and growth opportunities within the country’s dynamic economy.

To leverage this behaviour, Axis Mutual Fund, one of India’s fastest-growing fund houses, has introduced the Axis Momentum Fund—an open-ended equity scheme following the Momentum Theme.

With a structured and model-based approach for a strong framework, the investment objective of the scheme is to generate long-term capital appreciation for investors from a portfolio of equity and equity related securities based on the momentum theme. There is no assurance that the investment objective of the scheme will be achieved.

Speaking about the launch, Mr. B Gopkumar, MD & CEO, of Axis Mutual Fund said, “India’s evolving economy presents distinct opportunities for those who can effectively leverage market trends.

Momentum investing, a strategy widely embraced globally, is especially relevant in the Indian context, where rapid sectoral shifts and evolving market dynamics create pockets of sustained outperformance.

Our launch of the Axis Momentum Fund aligns with our commitment to continuously innovate and offer investors access to cutting-edge investment strategies that align with evolving market dynamics. By harnessing the power of momentum investing, we aim to unlock new avenues for growth, offering our investors a differentiated approach to achieving their financial goals.”

Understanding Momentum Investing

Momentum investing, as a strategy focuses on identifying and capitalizing on underlying securities with strong upward trends. Unlike the usual approach of seeking undervalued stocks or high-growth companies, momentum investing embraces the principle of “buying high to sell higher.” While often simplified, momentum investing is rooted in rigorous quantitative analysis.

By applying robust filters, the strategy screens for stocks with strong performance indicators, making it adaptable to varying market conditions and reducing the influence of emotional biases on decision-making. In India, momentum investing benefits from historical performance data, with momentum indices like the Nifty200 Momentum 30 frequently outperforming broader benchmarks on a risk-adjusted basis.

Axis Momentum Fund

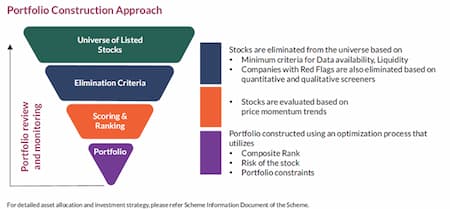

The Axis Momentum Fund offers a unique model-driven approach, systematically identifying and investing in high-momentum securities across sectors. The fund employs a framework that filters securities by considering data availability and liquidity, and then evaluates them based on price momentum trends. Essentially, the portfolio construction uses an optimized process that utilizes Composite Rank, Risk of the Stock, and Portfolio Constraints.