Bengaluru, October 11, 2024 : Vedanta Resources Finance II PLC (VRF) has repaid $869 million to bondholders holding 13.875% bonds due in 2027 and 2028, respectively. According to the company’s various Singapore exchange filings, the payments were made in multiple phases in October.

For the 13.875% bonds due in 2027, the company repaid $470 million ($429,974,800 and $40,025,200 as per filings on October 4 and October 9). As per VRF’s exchange filing, with the repayment on October 4, the 2027 bonds have been fully redeemed and are no longer outstanding. Similarly, the company has repaid $399 million to bondholders holding its 13.875% bonds due in 2028.

These repayments are part of a larger liquidity management exercise under which VRF is repaying bonds with a higher interest rate to save on interest costs. As per a September 11 filing, redemption of bonds due in 2027 and 2028 and refinancing them with new bonds due in 2029 will result in an interest saving of 3% p.a. for VRF.

Bond Rally

Recent steps to deleverage the balance sheet at the London-based Vedanta Resources Limited and its Indian subsidiary Vedanta Limited have caused a rally in the bonds issued by the group entities.

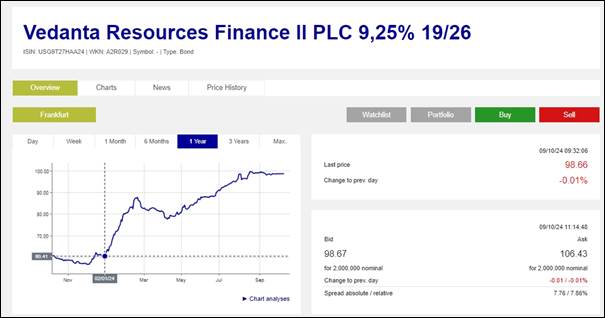

VRF’s 9.25% bond due in 2026 has rallied nearly 63% on the Frankfurt bourse, nearing the 52-week high of 99.56 on the exchange.

According to Vedanta’s latest investor presentation, VRL’s standalone debt was reduced by almost $4.5 billion—from a recent high of $9.7 billion in March’22 to $5.2 billion in September’24. VRL’s current group net debt to EBITDA ratio has also improved from 3.3X in FY20 to 2.2X.

S&P Global had upgraded VRL’s rating in July to ‘B-‘ from ‘CCC+’ while assigning a stable outlook, citing various factors. It expects VRL debt to decline by another US$1 billion to about US$4.5 billion by July 2025, while interest expenses may drop to US$550 million – US$600 million by the end of FY2025 (ending March 31, 2025). The ratings agency cited the presence of adequate internal funds which will help VRL in addressing US$1.4 billion of debt maturities.